Table of Contents

- How to Use the Boat Loan Calculator

- Understanding Your Boat Loan Results

- What is a Boat Loan?

- Why a Boat Loan Calculator is Essential

- Key Factors That Affect the Cost of a Boat Loan

- How to Reduce Boat Loan Costs

- How to Finance Your Boat Purchase

- Understanding Boat Loan Terms

- Budgeting for Boat Ownership Costs

- Consult a Financial Expert

- FAQ

How to Use the Boat Loan Calculator

Our easy-to-use Boat Loan Calculator helps you estimate your monthly payments and total loan costs in just five simple steps.

1. Enter the Purchase Price

Input the total cost of the boat before applying your down payment. This includes the base price and any additional costs.

2. Set Your Down Payment

Select how you want to enter your down payment—either as a percentage (%) of the purchase price or as a fixed dollar ($) amount.

3. Loan Amount Calculation

This field automatically calculates your loan amount by subtracting the down payment from the purchase price—no manual entry required.

4. Specify Interest Rate

Enter the annual interest rate for your loan. If unsure, use an estimated rate based on your credit score and market conditions.

5. Choose Loan Term

Select the loan term in years. A longer term may reduce monthly payments but could increase the overall interest paid.

6. Calculate Your Loan

Click the Calculate button to generate a detailed estimate of your monthly payments, total interest paid, and overall loan costs.

By following these steps, you can easily compare different loan options and choose the best financing plan for your boat purchase.

Understanding Your Boat Loan Results

Once you use our Boat Loan Calculator to estimate your monthly payments, total loan cost, and interest paid, it’s crucial to interpret these results for better financial planning. Below is a breakdown of key loan terms:

- Monthly Payment: The fixed amount you’ll pay each month, covering both the principal loan balance and interest.

- Total Loan Duration: The total number of months required to repay your boat loan.

- Total Loan Cost: The sum of the loan amount plus total interest over the repayment period.

- Total Interest Paid: The cumulative interest you’ll pay over the loan term. Lower interest rates and shorter loan terms help minimize this cost.

- Amortization Schedule: A detailed breakdown of each payment, showing how much goes toward the principal vs. interest, helping you track your loan balance over time.

Visualizing Your Loan with Charts

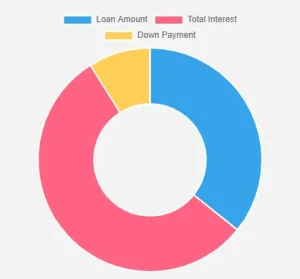

Donut Chart: Loan Breakdown

The donut chart provides a visual summary of your loan’s key components, making it easier to understand the total cost.

What It Represents:

- Blue (Loan Amount): The borrowed amount.

- Pink (Total Interest Paid): The total interest accrued over the loan term.

- Yellow (Down Payment): The upfront payment made at purchase.

Why It Matters:

This chart helps you visually compare the loan amount, interest, and down payment, allowing for better financial decision-making.

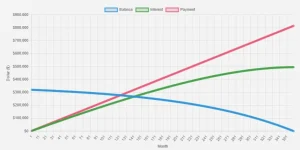

Multi-Line Chart: Loan Progression Over Time

The multi-line chart illustrates how your loan balance, interest, and monthly payments change over time.

Key Indicators:

- Blue Line (Loan Balance):

- Shows the remaining loan balance as it decreases monthly.

- Steady downward slope indicates debt reduction over time.

- Green Line (Interest Paid):

- Displays how much of each payment is allocated toward interest.

- Decreases over time as more of your payment goes toward principal.

- Pink Line (Total Monthly Payment):

- Represents the consistent monthly payment amount in a fixed-rate loan.

Why It Matters:

- Visualizes how your loan balance decreases over time.

- Shows how interest payments decline as more goes toward the principal.

- Helps in planning finances based on a predictable payment schedule.

By analyzing these charts, you can make informed decisions about your boat financing, adjust your loan terms, and optimize your repayment strategy.

What boating enthusiast does not get excited about the idea of cruising across open water — wind in your hair and sun on your face. However, before you get caught into that adventure there are some steps to addressing one of the most important parts — how will I pay for this dream boat! Enter our Boat Loan Calculator. The purpose of this Boating Finance Calculator Tool is to provide you with a better understanding regarding the financial aspects involved in buying a boat, thereby easing out your journey. No matter if you are a long time seaman, or only just starting to make your purchase these guides will provide the insight.

What is a Boat Loan?

A boat loan is a specialized financing option designed to help buyers purchase a boat by spreading the cost over time. Similar to auto loans, boat loans allow borrowers to make manageable monthly payments rather than paying the full price upfront. Lenders offer various loan terms, interest rates, and repayment options based on financial eligibility.

Most boat financing options are secured loans, meaning the boat itself serves as collateral. This reduces lender risk and can lead to lower interest rates compared to unsecured loans. However, borrowers should carefully review loan terms and ensure timely repayments to avoid the risk of repossession.

Understanding how boat loans work is essential for making informed financial decisions. By comparing loan rates, terms, and repayment options, you can choose the best financing solution that fits your budget—getting you on the water faster and stress-free.

Why a Boat Loan Calculator is Essential for Smart Financing

Securing a boat loan can involve many uncertainties, from interest rates to monthly payments. A Boat Loan Calculator simplifies the process by providing instant, accurate estimates, helping you plan your financing with confidence. This tool allows you to calculate your monthly payment, total interest paid, and loan term—giving you a clear financial outlook.

Key Benefits of Using a Boat Loan Calculator

- Transparency & Clarity: Converts complex financial details into easy-to-understand figures, helping you make informed decisions.

- Budget Planning: Helps you anticipate all expenses, reducing financial surprises along the way.

- Loan Comparison: Allows you to test different loan terms and interest rates to find the best financing option for your budget.

For anyone considering boat ownership, a Boat Loan Calculator is a must-have tool to streamline the decision-making process and ensure a financially sound purchase.

Key Factors That Affect the Cost of a Boat Loan

When financing a boat, several factors influence the total cost of your loan. Understanding these elements can help you make informed financial decisions and secure the best possible terms.

- Interest Rates: Your boat loan interest rate plays a major role in determining your overall loan cost. Interest rates vary based on your credit score, loan term, and market conditions. A lower rate means lower monthly payments and less interest paid over time.

- Loan Term: The length of your loan affects both your monthly payment and total interest costs. Longer loan terms reduce monthly payments but result in higher interest costs over time. Shorter terms mean higher monthly payments but less interest paid overall. Choosing the right balance is key to staying within your budget.

- Down Payment: A higher down payment reduces the loan amount, leading to lower monthly payments and reduced interest costs. Many lenders require a 20% down payment, but putting more money upfront can save you even more in the long run.

By understanding these key factors, you can tailor your boat financing to work in your favor and align with your long-term financial goals.

Boat Loan Calculator – Simplify Your Financing

Our Boat Loan Calculator is a powerful tool designed to help you estimate your monthly payments, total interest, and loan affordability. By eliminating the guesswork, this calculator provides accurate financial projections, making boat financing easier to understand.

Why Use Our Boat Loan Calculator?

- Customizable Loan Inputs: Adjust the loan amount, interest rate, and repayment term to see how different factors affect your monthly payment and total cost.

- Comprehensive Loan Summary: Get a detailed breakdown of your loan, including the principal balance, interest costs, and total repayment amount, ensuring full transparency.

- User-Friendly Interface: Our intuitive design makes it simple to enter your details and receive instant results without any hassle.

By using our Boat Loan Calculator, you can make informed financial decisions, compare different financing options, and plan your purchase with confidence.

How to Reduce Boat Loan Costs

Lowering your boat loan expenses can save you money and make boat ownership more affordable. Here are some effective ways to secure a better loan deal:

- Boost Your Credit Score: A higher credit score can help you qualify for lower interest rates and better loan terms. Pay off outstanding balances, make timely payments, and check your credit report for errors to improve your score.

- Compare Loan Offers: Don’t settle for the first offer—shop around and compare rates from banks, credit unions, and online lenders. Getting multiple quotes ensures you secure the best financing terms available.

- Increase Your Down Payment: A larger down payment reduces the loan amount, leading to lower monthly payments and less interest paid over time. Aim for at least 20% of the boat’s purchase price if possible.

By following these strategies, you can reduce your boat loan costs, improve your financial flexibility, and make your dream of boat ownership a reality.

How to Finance Your Boat Purchase

Buying a boat is an exciting milestone, but for many, it requires securing the right boat loan. Financing a boat isn’t just about getting loan approval—it involves careful budgeting, comparing loan options, and making informed decisions.

Assess Your Budget: Before exploring loan options, evaluate how much you can afford. Consider not just the boat price but also ongoing expenses such as insurance, maintenance, docking fees, and fuel costs.

Compare Loan Offers: Shop around for the best boat loan interest rates, repayment terms, and lender options. Look beyond the lowest interest rate—make sure the loan terms align with your budget and long-term financial goals.

Plan for the Future: A well-structured loan ensures that boat ownership remains enjoyable without becoming a financial burden. Making smart financing decisions today will help you enjoy your boat for years to come.

Understanding Boat Loan Terms: What to Look For

Before signing a boat loan agreement, it’s essential to understand the key terms, fees, and conditions. Carefully reviewing the loan details can help you avoid unexpected costs and ensure the loan aligns with your financial goals.

Key Factors to Consider:

- Interest Rates & APR: Check whether the rate is fixed or variable and understand how it impacts your total repayment.

- Loan Fees & Penalties: Be aware of origination fees, late payment penalties, and any hidden charges.

- Early Repayment Terms: Some loans charge prepayment penalties. Ensure you have the flexibility to pay off your loan early if desired.

Understanding these terms empowers you to make an informed decision, helping you secure a boat loan that fits your budget without unexpected surprises.

Budgeting for Boat Ownership Costs

Owning a boat involves more than just the purchase price. There are ongoing expenses that can add up quickly, and planning for them is essential. Some key costs to consider include:

- Insurance: Protect your investment with the right coverage, which varies based on boat type, size, and usage.

- Maintenance & Repairs: Regular servicing, cleaning, and unexpected repairs can be costly over time.

- Storage & Docking Fees: Whether you keep your boat at a marina or in dry storage, these costs should be factored into your budget.

- Fuel & Operating Costs: Larger boats consume more fuel, and expenses can fluctuate based on usage and fuel prices.

By budgeting for these additional expenses upfront, you can avoid financial surprises and enjoy boat ownership without stress.

Consult a Financial Expert

Working with a financial advisor or marine financing specialist can provide valuable insights tailored to your unique situation. They can help you navigate loan terms, interest rates, and repayment options, ensuring you make a well-informed decision.

By seeking expert guidance, you can streamline the boat-buying process, minimize financial stress, and focus on enjoying your new investment with confidence.

Boat financing can seem complex, but with the right tools and knowledge, you can navigate the process smoothly and get on the water faster. While securing a loan takes time, our Boat Loan Calculator simplifies the process in seconds, providing precise financial details tailored to your needs.

By understanding what influences boat loan rates, using cost-saving strategies, and seeking expert advice, you can turn your dream of boat ownership into reality. Remember, the goal is to maximize your time enjoying the open water—not stressing over financing.

Ready to set sail? Use our Boat Loan Calculator to get pre-approved today and make your dream boat a reality. Happy boating!

You may also find useful information on How do boat loans work? for more details.

You may also like Loan Calculator | Aircraft Loan Calculator | Mortgage Recast Calculator | Mortgage Calculator | Bridge Loan Calculator

FAQ