Table of Contents

- Using the Loan Calculator Efficiently

- Understanding the Loan Calculator Results

- Understanding the Charts

- Understanding the Monthly Amortization Schedule

- Types of Loan Calculators

- Essential Features of Loan Calculators

- Why Should You Use a Loan Calculator?

- Common Mistakes to Avoid

- Popular Loan Calculator Tools

- FAQ

Using Loan Calculator Efficiently

Our loan calculator is designed to be simple and intuitive. Follow these step-by-step instructions to get started:

1. Enter the Loan Amount

This is the total amount you plan to borrow. Input the full loan amount before interest is applied.

2. Specify the Interest Rate

Enter the annual interest rate provided by your lender. If you’re unsure, you can use an estimated rate based on current market conditions.

3. Enter the Loan Duration

Input the number of years over which you plan to repay the loan. Common loan terms range from 1 to 30 years.

4. Click the “Calculate” Button

Once all required fields are filled, click the Calculate button.

- Your estimated monthly payment.

- The total interest paid over the loan term.

- The total cost of the loan (principal + interest).

Explore Different Scenarios

Adjust the loan amount, interest rate, or loan duration to see how different factors affect your monthly payments and total loan cost. This helps you make informed financial decisions before borrowing.

Understanding the Loan Calculator Results

How to Analyze Your Loan Payment Breakdown

Use the loan calculator results to assess your financial obligations and make informed borrowing decisions.

1. Monthly Payments

Your monthly loan payment is the amount you need to pay each month to repay your loan.

- Calculated based on the loan amount, interest rate, and loan term.

- Ensures you stay on track with repayments without financial strain.

- Helps in budgeting and financial planning.

2. Total Loan Payments

This represents the total number of payments required to fully repay your loan.

- For example, a 5-year loan term consists of 60 monthly payments.

- Longer loan terms lead to smaller monthly payments but higher total interest.

3. Total Cost of Loan

The total amount you will pay over the loan duration, including principal and interest.

- A key factor in evaluating the affordability of a loan.

- Longer terms increase the total cost due to accumulating interest.

4. Total Interest Paid

The total interest cost over the life of the loan.

- A lower interest rate or shorter term helps minimize this amount.

- Extra payments or early repayments can reduce total interest.

Understanding the charts

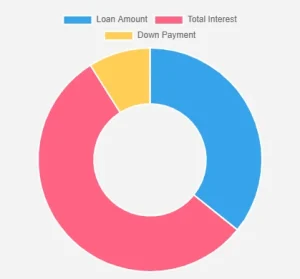

Donut Chart:

This is a variation of a pie chart with a hollow center. It is commonly used to visualize proportions or percentages of components within a whole.

What it Represents:

- Blue (Loan Amount): The portion of the total cost representing the loan amount borrowed.

- Pink (Total Interest): The portion representing the total interest paid over the life of the loan.

Purpose:

This chart visually breaks down the components of the total cost of the loan (Loan Amount + Total Interest) to show their relative contributions. The legend at the top helps identify each segment.

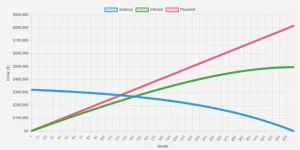

Multi Line Chart:

This is a multi-line chart, often used to represent changes or trends over time. Here’s what it shows based on the legend and the lines:

What It Represents:

- Blue (Balance):

- Represents the remaining loan balance over time.

- The line slopes downward as the balance decreases with each payment.

- Green (Interest):

- Represents the portion of the monthly payment allocated to interest over time.

- This line typically curves downward as the interest portion decreases while the principal portion increases (common in amortized loans).

- Pink (Payment):

- Represents the total monthly payment.

- It remains constant throughout the loan term in a fixed-rate loan.

Purpose:

- This chart is useful for visualizing how a loan progresses over its term:

- The balance decreases steadily.

- The interest portion starts high but diminishes as more of the payment is applied to the principal.

- The total payment remains fixed (assuming a fixed-rate loan).

The information data obtained from interpreting these results and charts will help you with your aircraft financing package decisions. By adjusting the purchase price, down payment, loan amount, interest rate and term you can find a sweet spot between monthly payments that fit your budget but still keeping total cost of loan to manageable level.

Understanding the Monthly Amortization Schedule

The amortization schedule provides a month-by-month breakdown of your mortgage payments, helping you track how your loan balance decreases over time. Here’s how to interpret each column:

1. Month

- Displays the specific month number in your loan term. For example, “1” represents the first month, “2” the second, and so on.

2. Principal

- The portion of your monthly payment that reduces the loan balance (the amount you borrowed).

- As time progresses, the principal portion increases because you pay less interest on the remaining loan balance.

3. Interest

- This is the amount you pay toward interest for that month.

- It is calculated based on the remaining balance of your loan and the interest rate.

- In the early stages of the loan, the interest portion is higher, gradually decreasing as the loan balance reduces.

4. Interest Paid

- A cumulative total of all interest payments made up to that month.

- This shows how much of your money has gone toward interest over the life of the loan so far.

5. Ending Balance

- The remaining loan balance after your monthly payment is applied.

- This figure decreases over time as more of your payment goes toward the principal.

How to Use This Table Effectively

- Track Loan Progress: See how your payments are distributed between principal and interest.

- Understand Interest Costs: Use the Interest Paid column to assess how much you are paying in interest over time.

- Plan for Early Payoff: If you want to pay off the loan early, this table can help you identify how much principal is left and calculate additional payments to achieve your goal.

In the world of personal finance, understanding loan costs is essential before making any borrowing decision. Whether you’re applying for a personal loan, auto loan, or business loan, knowing your repayment details upfront can save you from financial surprises. A loan calculator helps estimate monthly payments, total interest, and overall loan costs, giving you a clear picture of affordability and budgeting. In this guide, we’ll explore how loan calculators work, their key features, and how they can assist you in making informed financial decisions.

Types of Loan Calculators

Loan calculators help borrowers make informed financial decisions by estimating monthly payments, total costs, and repayment schedules. Whether you’re planning a personal loan, auto loan, or business loan, these calculators provide essential insights. Here are some key types:

- Loan Payment Calculator: Estimates your monthly payments based on loan amount, interest rate, and term.

- Loan Affordability Calculator: Helps determine how much you can borrow without exceeding your budget.

- Refinance Calculator: Compares your current loan with potential refinancing options to calculate savings.

- Amortization Calculator: Breaks down your loan payments into principal and interest over time.

- Early Payoff Calculator: Shows how extra payments can reduce interest costs and shorten the loan term.

- APR Calculator: Calculates the true cost of a loan, including interest and additional fees.

Using a loan calculator can help you plan better, compare different loan options, and make more informed financial decisions.

Essential Features of Loan Calculators

Loan calculators come equipped with various features to help borrowers make informed financial decisions. These key elements enhance accuracy and ease of use:

- Customizable Inputs: Adjust loan amount, interest rate, loan term, and down payment to match your financial needs.

- Interactive Charts & Tables: Visual breakdowns help illustrate monthly payments, interest accumulation, and loan balance over time.

- Payment Breakdown: See how each payment is allocated toward principal, interest, and fees, giving a clearer picture of total costs.

- Affordability Analysis: Input your income and expenses to determine a loan amount that fits your budget comfortably.

- Comparison Tools: Evaluate multiple loan options side by side to find the best financing terms.

With these features, loan calculators provide a precise and convenient way to plan your borrowing strategy effectively.

Why Should You Use a Loan Calculator?

A loan calculator is a valuable tool that provides essential insights for borrowers. Here’s why using one can make a difference in your financial planning:

- Financial Clarity: Understand your monthly loan payments in detail, ensuring they align with your budget and repayment capacity.

- Quick & Accurate Estimates: Avoid manual calculations and get instant, precise results to compare different loan options efficiently.

- Informed Decision-Making: Experiment with various loan amounts, interest rates, and terms to find the most affordable repayment plan.

- Better Budgeting: Ensure that your loan payments fit within your financial plan, preventing over-borrowing and financial strain.

- Stress-Free Borrowing: Gain confidence in your loan application by eliminating uncertainties and understanding your repayment obligations upfront.

Whether you’re applying for a personal, auto, or business loan, a loan calculator helps you plan smarter and borrow responsibly.

Common Mistakes to Avoid When Using a Loan Calculator

Loan calculators are powerful financial tools, but mistakes in usage can lead to inaccurate projections. Here are some common pitfalls to watch out for:

- Entering Incorrect Data: Mistyping loan amounts, interest rates, or loan terms can lead to unreliable results. Always double-check your inputs.

- Ignoring Additional Costs: Many loans come with extra charges such as processing fees, insurance, or prepayment penalties. Failing to account for these can lead to unexpected expenses.

- Overlooking Interest Variations: Some loans have variable interest rates. If you assume a fixed rate in your calculations, your actual payments may differ significantly over time.

- Not Factoring in Early Payments: Many borrowers plan to pay off loans faster, but some calculators don’t include prepayment effects. Using an advanced calculator that considers extra payments can provide a clearer picture.

- Using One Calculator for All Loans: Different loan types (personal, auto, business, mortgage) have unique factors. Ensure you’re using the right tool for the type of loan you’re applying for.

By avoiding these mistakes, you can ensure that your loan calculations provide an accurate and realistic picture of your financial commitments.

Popular Loan Calculator Tools

Here are some of the most widely used loan calculators that help borrowers estimate payments and plan their finances:

- Bankrate Loan Calculator: A versatile tool that calculates payments for personal, auto, and business loans with detailed breakdowns.

- NerdWallet Loan Calculator: This loan calculator helps users estimate affordability and compare different loan offers based on interest rates and repayment terms.

- Credit Karma Loan Calculator: This calculator offers insights into loan payments, total interest costs, and payoff strategies.

- Calculator.net Loan Calculator: A user-friendly tool that supports various loan types, including personal and car loans.

- SoFi Loan Calculator: This calculator designed for student, personal, and home improvement loans, providing clear payment schedules and interest details.

- Chase Auto Loan Calculator: A specialized tool for estimating car loan payments based on vehicle price, interest rate, and term length.

Loan calculators are essential tools for anyone considering a loan. They provide accurate estimates, save time, and help you make well-informed financial decisions. By understanding the different types of loan calculators, their features, and how to use them effectively, you can plan your finances with confidence and avoid unnecessary financial strain.

You may also find useful information on how a loan calculator works for more details.

You may also like Mortgage Recast Calculator | Mortgage Calculator | Bridge Loan Calculator

FAQ

- Loan amount

- Interest rate

- Loan term (years or months)

- Down payment (if applicable)