Table of Contents

- Using the Mortgage Calculator Efficiently

- Understanding the Results

- Understanding the Charts

- Understanding the Monthly Amortization Schedule

- Types of Mortgage Calculators

- Crucial Elements of Mortgage Calculators

- Why Do You Need a Mortgage Calculator?

- Common Mistakes to Avoid

- Popular Mortgage Calculator Tools

- FAQ

Using Mortgage Calculator Efficiently

Our mortgage calculator is designed to be simple and intuitive. Follow these step-by-step instructions to get started:

1. Enter the Purchase Price

- This is the total cost of the home before applying any down payment. Input the full price of the property you plan to purchase.

2. Enter the Down Payment

- Specify the amount you plan to pay upfront. You can choose either a percentage (%) of the purchase price or a fixed dollar amount ($).

- If you select %, enter the percentage of the property price you will pay as a down payment.

- If you select $, input the exact amount of money you will pay.

3. Amount (Auto-Calculated)

- You don’t need to fill in this field! The loan amount is automatically calculated based on the purchase price and down payment you entered.

4. Specify the Interest Rate

- Enter the annual interest rate provided by your lender. If you’re uncertain, you can use an average rate based on the current market conditions.

5. Specify the Loan Term

- Input the number of years you plan to repay the loan. Typical terms range from 5 to 30 years, depending on your lender and financial situation.

6. Click the “Calculate” Button

- Once all the required fields are filled, click the Calculate button.

- The calculator will instantly display:

- Your estimated monthly payments.

- The total cost of borrowing, including interest.

- Additionally, you’ll see an easy-to-understand visual graph of your mortgage details.

Explore Different Scenarios

- Adjust the purchase price, down payment, interest rate, or loan term to explore various financial scenarios. This helps you find the best mortgage solution for your needs.

Understanding The Results

You can gain valuable insights from the mortgage calculator results. Here’s how to interpret them:

1. Monthly Payments

- This is the amount you need to pay each month to repay your mortgage.

- It is calculated based on the loan amount, interest rate, and loan term.

- Make sure this payment comfortably fits into your monthly budget and doesn’t create financial strain.

2. Total Payments

- This represents the total number of months required to pay off the loan.

- For example, a 30-year loan term will typically consist of 360 monthly payments.

3. Total Cost of Loan

- This includes both the initial loan amount and the total interest paid over the life of the mortgage.

- It’s essential to focus on this figure, as it reflects the overall amount you will pay for your home, including interest.

4. Total Interest

- This is the total amount of interest you will pay throughout the life of the loan.

- A lower interest rate or shorter loan term can significantly reduce this figure.

Understanding the charts

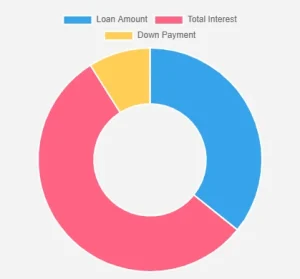

1. Donut Chart:

This is a variation of a pie chart with a hollow center. It is commonly used to visualize proportions or percentages of components within a whole:

What it Represents:

- Blue (Loan Amount): The portion of the total cost representing the loan amount borrowed.

- Pink (Total Interest): The portion representing the total interest paid over the life of the loan.

- Yellow (Down Payment): The portion representing the upfront down payment made at the time of purchase.

Purpose:

This chart visually breaks down the components of the total cost of the loan (Loan Amount + Total Interest + Down Payment) to show their relative contributions. The legend at the top helps identify each segment.

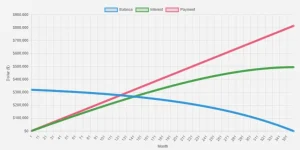

2. Multi Line Chart:

This is a multi-line chart, often used to represent changes or trends over time. Here’s what it shows based on the legend and the lines:

What It Represents:

- Blue (Balance):

- Represents the remaining loan balance over time.

- The line slopes downward as the balance decreases with each payment.

- Green (Interest):

- Represents the portion of the monthly payment allocated to interest over time.

- This line typically curves downward as the interest portion decreases while the principal portion increases (common in amortized loans).

- Pink (Payment):

- Represents the total monthly payment.

- It remains constant throughout the loan term in a fixed-rate loan.

Purpose:

- This chart is useful for visualizing how a loan progresses over its term:

- The balance decreases steadily.

- The interest portion starts high but diminishes as more of the payment is applied to the principal.

- The total payment remains fixed (assuming a fixed-rate loan).

The information data obtained from interpreting these results and charts will help you with your aircraft financing package decisions. By adjusting the purchase price, down payment, loan amount, interest rate and term you can find a sweet spot between monthly payments that fit your budget but still keeping total cost of loan to manageable level.

Understanding the Monthly Amortization Schedule

The amortization schedule provides a month-by-month breakdown of your mortgage payments, helping you track how your loan balance decreases over time. Here’s how to interpret each column:

-

Month

- Displays the specific month number in your loan term. For example, “1” represents the first month, “2” the second, and so on.

-

Principal

- The portion of your monthly payment that reduces the loan balance (the amount you borrowed).

- As time progresses, the principal portion increases because you pay less interest on the remaining loan balance.

-

Interest

- This is the amount you pay toward interest for that month.

- It is calculated based on the remaining balance of your loan and the interest rate.

- In the early stages of the loan, the interest portion is higher, gradually decreasing as the loan balance reduces.

-

Interest Paid

- A cumulative total of all interest payments made up to that month.

- This shows how much of your money has gone toward interest over the life of the loan so far.

-

Ending Balance

- The remaining loan balance after your monthly payment is applied.

- This figure decreases over time as more of your payment goes toward the principal.

How to Use This Table Effectively

- Track Loan Progress: See how your payments are distributed between principal and interest.

- Understand Interest Costs: Use the Interest Paid column to assess how much you are paying in interest over time.

- Plan for Early Payoff: If you want to pay off the loan early, this table can help you identify how much principal is left and calculate additional payments to achieve your goal.

In such a fast-paced industry, experience is the best teacher and that goes without saying when it comes to buying property and getting a mortgage. Knowing your expenses up front can make a huge difference whether you are a first time home buyer or an experienced real estate investor. Mortgage calculators make it easy to estimate monthly payments, as well as help you visualize how interest affects your affordability and fit within a budget. To help you better understand mortgage calculators, we are going to talk about what they really offer with their different types and features in this guide!

Types of Mortgage Calculators

Mortgage calculators come in many varieties and are specialized based on the information the home buyer inputs. Here are some common types:

- Basic Mortgage Calculator: Estimates monthly payments by entering the loan amount, interest rate, and loan term.

- Maximum Investment Calculator: Helps you determine the maximum house price and mortgage you can afford to avoid payment shock.

- Refinance Calculator: Estimates the potential savings from refinancing an existing mortgage at a new interest rate.

- Amortization Calculator: Breaks down your loan payments over time, showing the division between principal and interest.

- Early Payoff Calculator: Illustrates the savings achieved by making extra payments to reduce the loan balance faster.

- APR Calculator: Calculates the Annual Percentage Rate (APR) to provide a clearer understanding of the total loan cost.

Crucial Elements of Mortgage Calculators

Mortgage calculators include various features to make them highly effective tools for home buyers. Key elements include:

- Flexible Inputs: Users can adjust loan amount, interest rate, loan term, and down payment to reflect their specific needs and financial situation.

- Visual charts and tables: Many calculators provide visual aids, such as charts and tables, to illustrate payments over time, offering a clearer understanding of the loan’s progression.

- Detailed Breakdown: On a granular level, some calculators show how each payment is allocated toward principal, interest, taxes, and insurance.

- Affordability Assessment: To determine how much you can afford, certain calculators allow you to input your income and monthly expenses, providing a realistic estimate.

- Comparison Tools: Advanced calculators enable users to compare multiple mortgage scenarios, helping them evaluate and choose the best option.

Why Do You Need a Mortgage Calculator?

Mortgage calculators are powerful tools that offer several benefits for potential home buyers. Here’s why you should use one:

- Financial Clarity: Gain a clear understanding of your mortgage payments, going beyond rough estimates to see detailed figures that match your financial situation.

- Time-Saving: Get quick and accurate estimates without needing to perform complex calculations or consult a professional, saving you time during the home-buying process.

- Informed Decision-Making: Experiment with various scenarios, such as loan amounts, interest rates, and terms, to choose the best mortgage option based on your financial state.

- Better Budgeting: Stay within your budget by determining the loan payment amount that aligns with your financial goals, helping you avoid overextending yourself.

- Reduced Stress: Eliminate the guesswork and reduce stress by gaining confidence in your mortgage application process, thanks to the clarity provided by the calculator.

Common Mistakes to Avoid

While mortgage calculators are excellent tools for home buyers, there are some common mistakes you should be aware of to ensure accurate results:

- Incorrect Data Entry: Inputting inaccurate information can lead to misleading results, causing you to base decisions on incorrect figures. Always double-check the loan amount, interest rate, and other details.

- Overlooking Additional Costs: Neglecting to account for property taxes, insurance, and maintenance can create a false impression that your monthly payments will be lower than they actually are.

- Ignoring Fees: Forgetting to include closing costs, loan origination fees, and other expenses can make your affordability estimate less accurate.

- Assuming Fixed Rates: Failing to consider changes in interest rates over time—especially for adjustable-rate mortgages (ARMs)—can result in unexpected financial challenges.

- Using One Calculator for All Scenarios: Different mortgage scenarios require specialized tools. Using a basic calculator for all situations may not provide the detailed insights you need.

Popular Mortgage Calculator Tools

Here are some of the most popular mortgage calculators that cater to various needs:

- Bankrate Mortgage Calculator: Offers a range of calculators for different mortgage requirements, making it versatile and comprehensive.

- Zillow Mortgage Calculator: The Calculator features a user-friendly interface with detailed affordability analyses, helping users make informed decisions.

- Quicken Loans Mortgage Calculator: This calculator highly rated for its accuracy and detailed breakdowns, providing valuable insights for potential borrowers.

- MortgageCalculator.org: A simple yet powerful tool that delivers clear and precise mortgage calculations.

- NerdWallet Mortgage Calculator: This calculator includes options for affordability assessments and loan comparisons, making it ideal for exploring different financial scenarios.

- Realtor.com Accunet Mortgage Calculator: Combines simplicity with advanced features, offering an easy-to-use interface for estimating values and monthly payment plans.

Mortgage calculators are invaluable tools for anyone considering a mortgage. They provide clear explanations, save time, and empower you to make informed decisions about your financial future. By understanding the different types of mortgage calculators, their features, and how to use them, you can take full advantage of these resources to plan confidently and effectively.

You may also find useful information on how a mortgage calculator works or check out this mortgage rates for more details.

You may also like Mortgage Recast Calculator | Loan Calculator | Bridge Loan Calculator

FAQ

- Loan amount

- Interest rate

- Loan term (in years)

- Down payment amount

Some calculators may also ask for property tax rates, insurance costs, and other fees for a more detailed estimate.