Table of Contents

- How to Use the Aircraft Loan Calculator

- Understanding Your Results

- What is an Aircraft Loan?

- Why an Aircraft Loan Calculator Is Essential

- What Determines the Costs of an Aircraft Loan

- Why Use Our Aircraft Loan Calculator

- Ways to Reduce Your Aircraft Loan Costs

- Walk the Rates

- Aircraft Financing Made Simple

- FAQ

How to Use the Aircraft Loan Calculator

Our airplane loan calculator is simple to use. Here is the full instruction to get started with it.

1. Enter Purchase Price:

It is the price to buy the aircraft. This is the cost of everything before your down payment.

2. Enter Down Payment:

This is the downpayment value you have to pay for buying the aircraft. You can either select ‘%‘ or ‘$‘. If it is percentage(%) then you have to input that how many percent of the Aircraft Purchase Price you have to pay as the downpayment. If it is dollar($), then you have to specify the amount you have to pay for the downpayment.

3. Loan Amount:

You don’t have to put any values in this field, as it is autometically calculate the Loan Amount from your submitted Purchase Price and DownPayment.

4. Specify the Interest Rate:

Key Annual interest rate, value given by your lender. If you are unsure, use an average value related to the present state of the market.

5. Specify the Loan Term:

Enter in the number of years you want for your loan term. Terms typically approved by lenders will vary from 5 to 20 years, based on the lender and your financial scenario.

After you input this data and click calculate button, the calculator will immediately display your estimated monthly payments as well as total cost of borrowing if any with essential visual graph data for better understanding. By playing with the inputs, you can investigate a range of scenarios to find the best possible finance solution for your purpose.

Understanding Your Results

You can gain valuable insights from the aircraft loan calculator results. Here’s how to interpret them:

- Monthly Payments: This is how much you would have to pay each month in order to get your loan paid off. This is calculated by the loan amount, interest rate and loan term. As always: Make sure it is a part of your monthly budget and doesn’t add financial strain.

- Total Payments: It shows the total months to pay off the loan.

- Total Cost of Loan: These are the initial loan amount, and total interest paid over the life of your mortgage. The most important to consider is the total cost of of loan because this ties into how much you will pay for your aircraft over all.

- Total Interest: This is the total interest paid over the life of the loan.

- Amortization Schedule: You will get an amortization schedule, which shows you how much of each payment is principal and interest and how much you have to pay monthly. Which helps you to understand how your loan balance is reducing over time.

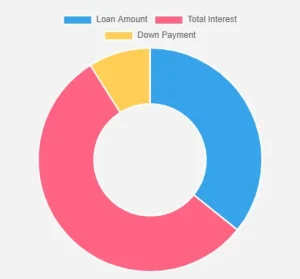

Understanding the charts

- Donut Chart: This is a variation of a pie chart with a hollow center. It is commonly used to visualize proportions or percentages of components within a whole.

- Blue (Loan Amount): The portion of the total cost representing the loan amount borrowed.

- Pink (Total Interest): The portion representing the total interest paid over the life of the loan.

- Yellow (Down Payment): The portion representing the upfront down payment made at the time of purchase.

What it Represents:

Purpose:

This chart visually breaks down the components of the total cost of the loan (Loan Amount + Total Interest + Down Payment) to show their relative contributions. The legend at the top helps identify each segment.

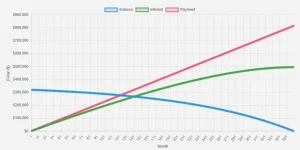

- Multi Line Chart: This is a multi-line chart, often used to represent changes or trends over time. Here’s what it shows based on the legend and the lines:

- Blue (Balance):

- Represents the remaining loan balance over time.

- The line slopes downward as the balance decreases with each payment.

- Green (Interest):

- Represents the portion of the monthly payment allocated to interest over time.

- This line typically curves downward as the interest portion decreases while the principal portion increases (common in amortized loans).

- Pink (Payment):

- Represents the total monthly payment.

- It remains constant throughout the loan term in a fixed-rate loan.

- This chart is useful for visualizing how a loan progresses over its term:

- The balance decreases steadily.

- The interest portion starts high but diminishes as more of the payment is applied to the principal.

- The total payment remains fixed (assuming a fixed-rate loan).

What It Represents:

Purpose:

The information data obtained from interpreting these results and charts will help you with your aircraft financing package decisions. By adjusting the purchase price, down payment, loan amount, interest rate and term you can find a sweet spot between monthly payments that fit your budget but still keeping total cost of loan to manageable level.

Buying an aircraft is not something anyone just goes out and buys everyday, but the finances are a mission to work out. For small business owners or future pilots, it is complicated enough to negotiate the world of aircraft financing. Read on to know about what an aircraft loan calculator is, how useful it can be and also help you make informed decisions that will probably land those aviation fantasies real far down the tarmac.

What is an Aircraft Loan?

A brand of a loan is an aircraft load and this type of finance was created just for buying an airplane. In a nutshell, aircraft loans are by which you gain access to that funding-similar to how car loans allow us to purchase cars or mortgages enable home buying. These loans also cover a variety of aircraft in the market, including small single-engine planes to large commercial jets.

Aircraft loans will be provided by the financial institutions, specialized aviation lenders, and some manufacturers under certain terms and conditions, in other words interest rates, repayment schedules and eligibility constraints. Some lenders also mandate a down payment (a percentage of the purchase price that you pay cash at closing) For one to be successful in this niche, it is important to have an understanding of these terms so that you obtain the best possible deal.

Finding the right type of aircraft loan is important as there are a lot more options available. So you should shop around for different loans. Here is where an aircraft loan calculator steps in to assist on the process and make you understand what all financial obligations are included.

Why an Aircraft Loan Calculator Is Essential

The cost of an aircraft loan can be broken down into multiple components related to the total amount borrowed, interest rate and term over which that money will be repaid. An aircraft loan calculator simplifies these variables and helps display the monthly payments as amortization schedule table & overall costs of your new purchase.

Doing it without the help of a machine can be really more daunting and error-prone. This is way too much work and you need a calculator that does this heavy lifting for you, takes care of all the complex math involved here, so find out how to simplify your life. This lets you compare options that include different metrics like principal amounts, rates of interest and term length to make sure a quote meets your unique financing requirements.

If you are a small business owner or student interested in becoming a pilot, an aircraft loan calculator is vital. This helps you in your budget and financial planning, it will be a good indicator if you can afford the loan without impacting other areas of your finances. While it is most useful as a tool for financial advisors and aviation experts to help their clients make wise choices about aircraft finance.

What Determines The Costs Of An Aircraft Loan

Aircraft loans sum up to a few things, all of them expensive. This can allow you to get a better deal on your loan and help you effectively manage your money.

- Loan Amount: How Much the Cost You want to borrow, that governs your loan amount and consequently mode of payment as well as a total price for a loan. More common loan amounts will typically increase in corresponding monthly payment sizes.

- Interest Rate: Your credit score, market conditions and the lender can all drive rates higher or lower. Lower the interest rate, more cost-effective a loan becomes.

- Loan Term: The longer your loan term, the lower your monthly payments will be, but the more interest you will pay over time. Conversely, shorter loan terms result in higher monthly payments but less total interest.

There are other variables such as the make, model and year of your aircraft as well as your financial profile that affect loan costs. Taking these into account allows you to understand the financial consequences of your aircraft loan and help doorstep one of the best financing alternatives.

Why use our aircraft loan calculator

- Using our aircraft loan calculator should help the process. Friendly to use, accurate and gives you results quickly enabling the maker of financial decisions, not only make informed but intelligent choices.

- It is a simple calculator, the input you need to provide: Purchase Price, Down Payment, Interest Rate and Loan Term. After you fill out those details, it will calculate your Total Cost of Loan, Total Interest, Monthly Payment and Total Payments along with charts for better understanding. It helps you to see how different variables impact on your loan costs and decide the best course of action.

- Our aircraft loan calculator is available online and accessible from any location with an internet connection. This service, managed by an appointed conservator, allows you to borrow against an aircraft and calculate your monthly payments. It is an excellent resource for anyone looking to finance an aircraft, whether you’re a first-time buyer or an owner of multiple airplanes.

Ways to reduce your aircraft loan costs

Trimming expenses by paying less in aircraft loan costs can end up being a big savings throughout the life of your loan. These are ways to slash on your spending:

- Improve Your Credit Score: In addition to this, a better credit score could give you access to lower interest rates on your loan. Clear outstanding debts, stay away from new credit requests and never miss your invoice payments for improving it.

- Increase Your Down Payment: By providing a bigger down payment, you reduce the principal amount that needs to be borrowed and therefore lower your monthly payment and total loan cost. Work towards keeping 20% of the aircraft purchase price available as a down payment.

- Opt for a Shorter Loan Term: Shorter loan terms (e.g., 15 or 20 years instead of 30) often come with lower interest rates. Although your monthly payments will be higher, you’ll pay significantly less interest overall.

- Shop Around for Competitive Rates:Compare loan offers from multiple lenders to find the best interest rate and terms. Consider working with lenders specializing in aircraft financing.

- Negotiate the Interest Rate: Some lenders may be open to negotiation, especially if you have a strong financial profile. Use competing offers as leverage to secure a lower rate.

- Refinance the Loan: If rates drop or your credit improves after taking out the loan, consider refinancing to get a lower interest rate or better terms. Be aware of any fees or penalties for refinancing.

- Make Extra Payments: Paying more than the minimum monthly amount helps reduce the principal faster, lowering the interest paid over time. Confirm there are no prepayment penalties with your lender.

- Avoid Unnecessary Add-ons: Be cautious of optional extras, such as extended warranties or insurance packages, that may increase your overall loan costs. Evaluate these add-ons independently to decide if they’re necessar

- Choose a Fixed Interest Rate: A fixed interest rate protects you from potential rate increases over the loan term, providing cost predictability.

- Lease vs. Purchase: If purchasing is not essential, consider leasing an aircraft instead, which may offer lower monthly costs and fewer upfront expenses.

Walk the Rates

Shop around and compare rates from multiple lenders to secure the best terms. The advantage of working with a broker is that they may be able to get you some good savings and give you access to unpublished offers.

While these tips may be basic and more common sense rather than advanced, they will definitely lower your landing fees which means aircraft loan costs making aviation dreams a little less out of the blue.

Aircraft Financing Made Simple

There is more to financing an aircraft purchase than just obtaining a loan. Other factors that need to be taken into account are insurance, service and maintenance costs.

- Aircraft Insurance: Secure your investment with full insurance cover. Compare rates to get the best deal and make sure you have comprehensive coverage that protects your aircraft from damage and any liability lawsuits.

- Cost of Maintenance and Operation: destruction-maintaining an aircraft in peak condition requires regular maintenance Factor in ongoing maintenance, including inspection costs and new parts or upgrades as well fuel and fees for hangar space.

- Tax Implications: Learn how your aircraft purchase is taxed. For tax advice that may apply to your aircraft ownership, contact a qualified professional.

These factors will keep your excesses in check and make buying the aircraft financially viable without breaking the bank.

Aircraft loan calculator is a tool which everyone considering an aircraft finance should use. Making it easy for you to calculate loan costs helps in taking more rational financial decisions and allows finding the best credit option suitable with your requirements.

As long as you know what goes into the cost of an airplane loan and follow our advice for keeping those costs low, you too can afford to live out your dreams in aviation without going broke. And take into account other elements of aircraft ownership as well – like insurance, ongoing maintenance and tax ramifications – to make sure you have a seamless and economically viable experience with your own business jet.

Ready to take the next step? Get your first taste of uncompromising freedom and calculate here all you want with our aircraft loan calculator today!

You may also find useful information on How Does Aircraft Financing Work? or check out this Financing a private aircraft 101 for more details.

You may also like Mortgage Recast Calculator | Loan Calculator | Bridge Loan Calculator | Boat Loan Calculator